As this year grinds on, even the most optimistic among us have surely had to search hard to find silver linings in this year’s events. As you read this, we now have a president-elect declared by the media and a president in office who is riding out the clock for the elections process to be […]

Categories

Investment Strategy During an Election Year

Investment Management‘This is the most important election of our lifetime’ are words we have heard every four years for as long as I can remember. This year is no different. Although most investors get anxious in an election year, the reality is that the fact that it is an election year does not matter as much […]

National Savings Day: 10 Ways to Save

Financial PlanningToday is National Savings Day and is a great opportunity to consider different ways you can save money and if you are saving enough. It is always a good idea to periodically review the basics of saving money and budgeting so that you are prepared in case of a financial emergency, or for large ticket […]

How to Choose the Right Financial Advisor

Financial PlanningWhen the thought comes to mind of contacting a financial advisor to assist with financial planning, some may dismiss the idea thinking they have not acquired enough wealth to warrant such services. That is simply not so. Financial planning services are for everyone and can help you set up and attain financial goals. Deciding to […]

National Financial Awareness Day: 8 Retirement Planning Tips

Financial Planning, Retirement PlanningToday is National Financial Awareness Day, and while this day is not widely known or as popular as other holidays, its purpose is significant. This day is a reminder to get your finances in order so you can be prepared for your future. Being financially aware can play a major role in how you spend […]

Rebalancing Your Portfolio During Challenging Times

Financial PlanningMost of us never would have predicted that we would be living through a pandemic in 2020. It has quite literally changed how we live. Schedules have changed, work priorities have shifted, how we handle our day-to-day activities is nothing like before, and moreover, finances may feel uncertain. Planning is not what it was six […]

The Suspension of Required Minimum Distributions for 2020

Financial Planning, Retirement PlanningCOVID-19 is a health crisis, and yet it has impacted so much more than our physical wellbeing. The requirements of stay-at-home orders have also affected many financially. In an effort to provide relief, legislation has been enacted as people and governments around the globe struggle to contend with and contain COVID-19. At the end of […]

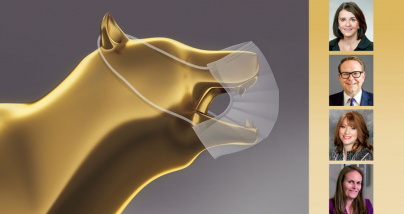

Positioning Client Portfolios:

Financial Planning, Retirement Planningby PQ STAFF | 2020 SUMMER Pittsburgh’s leading wealth managers tell how they’re positioning clients in this fraught environment (Part I) Alison F. Wertz, Bill Few Associates As a financial advisor, the only certainty I can guarantee my clients is that eventually there will be a recession. In almost every meeting with clients, I talk about what […]

We Are Here. Keep Your Appointment with Your Financial Advisor.

Financial Planning, Retirement PlanningWith the world operating differently lately, we realize your priorities may have shifted, and understandably so. But while many things have changed and are changing, one thing still holds true at Bill Few Associates – our commitment to you and your financial well-being. Our financial advisors are working remotely at this time, but they arehere […]

Retirement Planning During Volatile Market Conditions

Financial Planning, Retirement PlanningIn times of sudden market downturns, and in this new COVID-19 economy, I am reminded of Rudyard Kipling’s advice to “keep your head when all about you are losing theirs.” I do this by focusing on each client’s individual investment strategy, not the noise. For instance, I may counsel a 40-year-old client with a 25-year […]