‘This is the most important election of our lifetime’ are words we have heard every four years for as long as I can remember. This year is no different. Although most investors get anxious in an election year, the reality is that the fact that it is an election year does not matter as much as one might think. Uncertainty is what the market does not like, and potential change with an election always comes with a hefty dose of the unknown. We are experiencing feelings of uncertainty even more so this year with the pandemic at hand, but that should not change your long-term investment strategy.

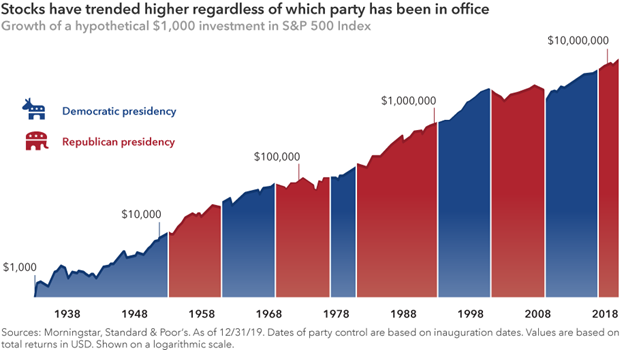

According to Capital Group economist Darrell Spence, “Presidents get far too much credit, and far too much blame, for the health of the U.S. economy and the state of the financial markets. There are many other variables that determine economic growth and market returns and, frankly, presidents have very little influence over them.” To that affect, the chart below reflects the long-term performance of the S&P 500 and respective presidential parties dating back to the 1930’s.

Another political uncertainty is what will happen if the results are unclear on November 3 or if either party contests the election which could have an impact on short-term market volatility. Even so, it would not be the first contested election. In 2000, stocks fell about 6% while Gore challenged the vote in Florida. Stocks also slumped before Bush’s narrow reelection in 2004. Nixon was pressured into contesting a close loss to Kennedy in 1960 but refused to do it. Contested elections happened numerous times in past decades and again, the market does not like uncertainty, but eventually the fog clears.

RELATED: Learn about stocks and what you need to know about growth vs. value.

Looking back, we have experienced good and bad markets as well as good and bad economies across all administrations. This time will likely be no different. The market will price in the results of the election within the first few weeks to several months then turn the focus back to ever important economic fundamentals.

In conclusion, regardless of the current election results, stay true to your long-term investment plan. Those who have done so in past election years have been rewarded much better than those who try to time the market. If you have questions about this information or your investment strategy, call us today at 412-630-6000 to find out how we can help you achieve your goals. Our experienced financial advisors are here to help.

(412) 630-6000

(800) 245-5939

(412) 630-6001 fax